Over 80% of global trade is seaborne. About two-thirds of the world’s oil and gas supply is either extracted at sea or transported by sea and up to 99% of global data flows are transmitted through undersea cables. None of this information is new but it pays to remind ourselves of these facts at a time when reliance on undersea infrastructure has never been higher and is likely only to increase.

The National Protective Security Agency (NSPA) provides the UK government’s definition of Critical National Infrastructure (CNI). While the definition applies to all infrastructure, not just maritime, terms like cables and pipelines are absent. CNI is defined by the impact of loss of its availability, integrity or delivery of essential services. The global economy and need for energy security leads us to conclude that a great deal of that seabed infrastructure is critical to the national interest.

Your infrastructure is at risk

Just as the technological explosion of land and air drones is re-writing land doctrine in Ukraine, the development of highly capable remotely operated and autonomous underwater vehicles has put more of our seabed based national infrastructure at risk from our from our adversaries. While communication pipelines tend to be buried, the nodes and shallow infrastructure are vulnerable, and oil and gas infrastructure is largely exposed and detectable with rudimentary technology.

Technology options

So how do modernising navies regain the advantage and protect our critical national infrastructure? Sub-surface and Seabed Warfare is not new, nor is it a discrete domain of underwater warfare. During Forcys’ discussions with navies around the world, we see the distinctions increasingly blurred between: port and harbour defence; persistent area surveillance; mine warfare; mine countermeasures; environmental protection compliance; hydrographic survey and military data gathering; intelligence collection; anti-submarine warfare and submarine operations. The enabling factor in this is off-board systems. Off-board systems can provide more mission options on increasingly scarce platforms. Containerised solutions provide operational flexibility to switch between roles.

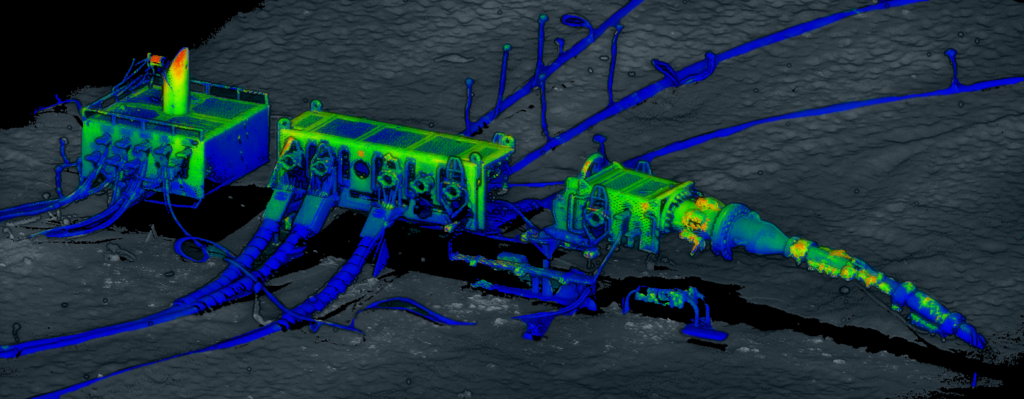

Navies are wise to consider the technical solutions that have been developed for the offshore energy and scientific research sectors. The offshore industries routinely deploy autonomous underwater vehicles (AUV) systems, remotely operated vehicles (ROV) systems, and towed vehicles – all capable of detailed inspections. The same technology that monitors pipeline health – from side-scan sonar to high-resolution laser scans and optical imagery – can be repurposed to identify suspicious activity. In the same way that the effectiveness of a navy is multiplied when it operates at sea (within reasonable limits it could be anywhere), the presence of credible autonomous systems provides an effective deterrent to an adversary. Exploration in deep water is leading to resident AUV and ROV systems performing surveys and maintenance between underwater re-charging and data transfer. These systems can be supported by precise positioning networks and through water communications to enable real-time monitoring, warning, and response. From a defensive perspective the presence of credible autonomous systems employed randomly in an outward surveillance mode may deter an adversary from their course of action.

Recent workshops relating to use of unmanned systems and the likelihood of our forces needing to operate in diverse and potentially unfamiliar environments to protect our nation’s interests all raise a common observation: that industry holds the bulk of the knowledge of what infrastructure lies on the seabed, what that infrastructure is carrying (to allow an assessment of how important it is) and the environmental conditions of the area. Recognising that offshore companies have paid large sums to obtain this data, some of which could be useful to a competitor, there is no appetite to freely share such information. A frequent comment by naval officers is that “you would not believe just how much infrastructure there was on the seabed”. This begs the question of whether navies are ready to operate safely and effectively within such an unfamiliar and poorly understood environment.

Partnerships

So, how can companies be encouraged to release the data they hold? Abstracted to a problem of source protection, security and sharing the answer is, optimistically, yes: anything is possible. But realistically, to overcome significant challenges including multinational ownership, individual company vulnerabilities and cost of implementation this must be government led. At Forcys we are encouraged by initiatives like NATO Digital Ocean and the establishment of the CNI Hub at NATO Maritime Command. At a national level in the UK where I am based, there is surely a role for the NSPA or UK Hydrographic Office in managing a limited access database of seabed infrastructure within the UKs Exclusive Economic Zone for use by UK Defence if required. Perhaps the most compelling reason to support data sharing is the benefits that the improved protection will bring. Time will tell.

Ultimately, the short-term future of seabed warfare does not lie exclusively in expensive new unproven technologies, but in smarter ways to use the tools we already possess alongside breakthrough capabilities. By working together, we can ensure the safety of our underwater lifelines, keeping the lights on and the world connected. At Forcys, we understand both the threat and the technology. We want to be where technology, experience and innovation meets security.

Justin Hains MBE left the Royal Navy in 2020. Among other professional qualifications, he completed the Advanced Mine Warfare Course and the Amphibious Operations Planning Course during a career as a Mine Warfare Clearance Diving Officer and Principal Warfare Officer (Underwater).

Forcys, a leading global maritime defence company, and SH Defence, part of SH Group, announced the signing of a Memorandum of Understanding (MOU) to explore the integration of Forcys’ advanced solutions into SH Defence’s Cube™ Modular Mission Capability system. The signing took place during the Combined Naval Event (CNE) in Farnborough (UK), with Ioseba Tena, Managing Director of Forcys, and Jimmy Gehring Sales Director of SH Defence, in attendance.

Forcys integrates and brings to the defence market world-changing solutions from leading technology partners Chelsea Technologies, EIVA, Sonardyne, Voyis, and Wavefront Systems. These companies are renowned for their innovative offering in underwater and maritime operations, making them ideal partners for SH Defence’s Cube™ system.

The Cube™ Modular Mission Capability system is the future in Maritime mission modularity. Capable of turning (almost) any platform into a future-proof multi-mission capability using interchangeable modules for all four dimensions of modern warfare.

This agreement follows the successful recent delivery of a Containerised ROTV (Remotely Operated Towed Vehicle) solution to a NATO Navy. In this project, Forcys’ sister company EIVA A/S delivered a ScanFish L ROTV, which was seamlessly integrated into an SH Defence Cube™, demonstrating the potential of this collaborative integration.

“We are excited about the opportunities this MOU brings,” said Ioseba Tena, Managing Director of Forcys. “Integrating our advanced solutions with the Cube™ system will provide operational flexibility and capability to naval forces worldwide. This collaboration underscores our commitment to enhancing maritime defence through innovation and strategic partnerships.”

Jimmy Gehring, Sales Director of SH Defence, echoed this sentiment, stating, “we are proud of the future cooperation with Forcys and look forward to promote our joint efforts to the defence industry.”

The MOU marks a significant step towards a deeper collaboration between Forcys and SH Defence. Both companies are committed to pushing the boundaries of what is possible in naval operations, leveraging their combined expertise to deliver state-of-the-art solutions to defence markets worldwide.

Discovery is a revolutionary new underwater camera system from Forcys technology partner Voyis that is changing the way we understand the underwater domain. In an interview with Luke Richardson VP for Sales and Marketing at Voyis, we discuss the origins of the Discovery, the challenges faced in its development, and the new optical payloads that are helping to transform our understanding of the underwater world.

Discovery was designed to remove the compromise between piloting and inspection cameras. Traditional underwater robotic systems (ROVs) have separate camera systems for piloting and inspection. Piloting cameras are designed with low latency in mind, which compromises the video and data quality of the camera to ensure the pilot has rapid response time. Whereas, inspection cameras provide high quality optical video and imagery, but are not trusted to provide low latency piloting capabilities, limiting the payload capacity for ROVs, particularly smaller platforms. Discovery Vision Systems consolidate these two functions into a single camera system. This gives operators access to high-quality imaging, low latency video feed, and, in the case of the Stereo variant, real-time depth perception, all from a single camera.

Luke Richardson explains, “New optical payloads are providing us with unprecedented insights into the underwater domain. The Discovery’s camera system, for example, uses a mix of high-quality optics and focus, combined with image enhancements done at the edge to generate actionable subsea datasets in real-time. This allows operators to see and understand the underwater world in a new way. It hasn’t been easy. One of the biggest challenges was developing a camera system that could meet the requirements for an effective subsea navigation and inspection tool, while fitting on a small inspection-class ROVs. Discovery Vision Systems are powered with the latest developments in computing capability to minimize the electronic stack, while still performing advanced corrections essential to deliver a superior inspection camera. In addition to optimizing the electronics to get the most out of the camera internals, the system also utilizes a 130° x 130° domed lens with full 4K resolution and crisp focus to provide platforms with increased situational awareness through piloting operations. Integrating this incredible field of view within the Discovery size limitations required mastery from Voyis’ design team. The development of the Discovery tackled the challenges and as a result the quality and capability of the system met the need of our objective, helping humans see the depths like we see the surface.”

In defence applications cameras have a critical role to play in providing improved situational awareness by helping to identify IEDs and mines, supporting autonomous manipulation tasks and obstacle avoidance.

Advanced optical and processing technology readily accessible

Discovery Vision Systems from Voyis use the Data Distribution Service (DDS) architecture to provide users with access to all the data they need to make informed decisions and perform inspections. DDS is a standard protocol that allows different systems to communicate with each other and share data in a real-time and efficient manner.

“You’d like to know why we would want to use DDS? It means we can provide the user with a number of outputs:

- Piloting feed: A live stills-to-video feed that is compressed for low latency.

- Raw image data set: A set of unprocessed images that can be used for further data refinement or inputs to customer proprietary enhancements.

- Processed image data set: A set of images that have been light levelled, undistorted, and colour corrected, optimal inputs for automatic target recognition software.

- Inspection video: A stills-to-video feed to re-live the survey to uncover more details after mission.

- 3D point cloud depth map (Stereo camera): 3D depth perception, mapping the environment to support autonomous manipulation, visual station keeping or docking, and tracking.

Users can simply subscribe to any of these data streams and receive them in real time. This allows users to create 3D models, make decisions, and perform inspections quickly and efficiently.”

Discovery Vision Systems are compliant with the Unmanned Maritime Autonomy Architecture (UMAA) framework, which is used by the US Navy. This means that the system can be easily integrated with other systems that use the UMAA framework. This makes it easy for users to deploy the Discovery Vision System on their own platforms and start using it immediately.

It’s child’s play

“You can’t underestimate the amount of effort that has gone into making the Discovery camera as simple to use as possible. We considered typical survey operations, and wanted to ensure that operators could maintain their general piloting missions without changing tasks or adding additional steps, but also wanted to ensure that the mission would gain a large advantage with the actionable datasets generated in real-time. I am happy to say that we have managed to do that. Discovery is a technical marvel, improving user experience and delivering outputs that are immediately accessible to any user.”

The technical innovations required to make this vision system work are numerous:

- Global shutter: Discovery uses a global shutter, which means that all pixels in the image are captured at the same time. This is important for maritime autonomy applications because it eliminates motion blur and distortion.

- High dynamic range: Discovery has a high dynamic range, which means that it can resolve features in the images with greater detail, whether the target is in very bright or very dark environments. This feature improves identification capabilities.

- 130° by 130° Dome: Discovery has a 130° by 130° Dome that provides very crisp imagery and colours with complete wide-area coverage delivering better situational awareness when performing piloting task or autonomous obstacle avoidance operations.

- High-powered lighting package: Discovery comes with a high-powered lighting package that includes two Nova Minis at 75,000 lumen each allowing the camera to operate in low-light conditions.

Why invest on your camera system?

“The camera is the most important sensor on an ROV. It is what allows you to see underwater without deploying a person. So why would you compromise and only rely on a low-latency camera with limited optimization for subsea environments? If you build the ROV to provide “eyes” in subsea environment for humans ashore, why would you compromise on the camera?,” Luke asks. “In a sense, customers should consider the camera they need to perform their operation before the platform, it is the sensors that enable humans to interpret the subsea domain, the ROV is simply the vessel to transport them.”

If you would like to find out more about Discovery or Voyis other optical systems, please contact us.

Doctrinally, the concept of amphibious operations has followed a deliberate linear approach from planning to termination with the landing force only entering the area of operations once rehearsal and re-embarkation have been completed to suit the requirements of the planned mission. As an example, the Royal Navy plans to deploy two Littoral Strike Groups (LSG) on a permanent basis, to extend the UK’s presence, insight, and influence globally. The most likely operating areas are the Indo-Pacific and North Atlantic Oceans. The forces are far more likely to be operating in the eventual amphibious operating area before an operation is conducted. In our view, the familiar acronym PERMSAT (Planning, Embarkation, Rehearsal, Manoeuvre, Shaping, Action, Termination) will be compressed to chronologically and geographically to three broad activities: persistent presence and posture; concentration of amphibious force, action and termination. But they will overlap and compete for resources and space. So how could the LSG maintain its situational awareness (and a degree of presence) while it must depart a littoral zone to reorganise and rehearse?

Advance force and pre-landing operations are predominantly covert in nature and sequenced as close or coordinated with the assault to minimise the resource and logistic burden and maintain the advantage of surprise.

Operational choices

Vessels operating on the surface are vulnerable and can disclose favoured channels or operating areas. Crewed Mine Countermeasures Vessels (MCMVs) require additional tailored defensive support if operating within enemy engagement range. Even uncrewed surface assets can be targeted by coastal defence missile and artillery systems which must be neutralised before assets are committed close to land. As swarm attacks by surface and air drones become more accurate and lethal, it is conceivable that surface assets will only be used once the landing force has committed to its area of operations and even then, at increased risk of destruction by enemy action.

So how does a pre-deployed LSG prepare itself for an assault when it is already in or close to its operating area? If stores and vehicles need to be reorganised from efficient and safe storage to assault order, the amphibious force will need to leave the littoral zone at the very time that it is looking to increase situational awareness. Meanwhile any advance force, pre-landing or MCM activity must operate without the need for additional defensive capabilities and without advertising the amphibious operating area geometry. The use of surface assets for low-risk deception only is a soft option that negates the need for adequate organic protection capability within the LSG design. The deduction is simple, mitigate for a denied or contested surface environment by augmenting sub-surface capabilities: the underwater domain is more covert and, for the time being at least, more survivable.

Technical options

Uncrewed, autonomous systems could be left behind to continue intelligence, surveillance, and reconnaissance (ISR) and MCM “tasking, and potentially as the senor-decider-effector chain is established they could contribute to area denial, pending the return of the amphibious force.

These assets could be mobile – either crawling or swimming before settling again to conserve power, to keep pace with the changing requirements of the littoral strike group and frustrate counter measures by the enemy. As the LSG achieves its objective and moves closer to sustain itself for as long as required, these assets could provide the seaward sensor/defensive screen or move with the task group to maintain a positioning network independent from GPS.

The sense-decide-effect system of system of systems will rely on a robust secure underwater communication network. In our vision exploiting the technology carried by each of the previously mentioned self-propelled nodes and vehicles.

Proven Capabilities

Our technology partners have over 50 years’ experience in the offshore energy sectors. Integration and testing in the amphibious context is the next step. Integration of acoustic array technology could maintain the force’s level of situational awareness. This technology is well understood and used extensively in the energy sector. Pre-positioned and pre-surveyed transponders can already provide centimetre accurate positioning independent of GNSS input. Sensor agnostic seabed nodes are already available, integration with acoustic, seismic, magnetic sensors is low risk and achievable within a very short time frame. Acoustic and optical communications options can support data transfers at speeds up to 1Gb/s depending on range.

Forcys is ready to help you now. Early engagement is needed to help solve the challenges the future operating space presents. We can use indicative blocks of proven technology to show you how our technology can help.

If you’d like to hear more about our vision of amphibious warfare in the future or think we could deliver some of these capabilities in partnership, contact us for more information.

Justin Hains MBE left the Royal Navy in 2020. Among other professional qualifications, he completed the Advanced Mine Warfare Course and the Amphibious Operations Planning Course during a career as a Mine Warfare Clearance Diving Officer and Principal Warfare Officer (Underwater).

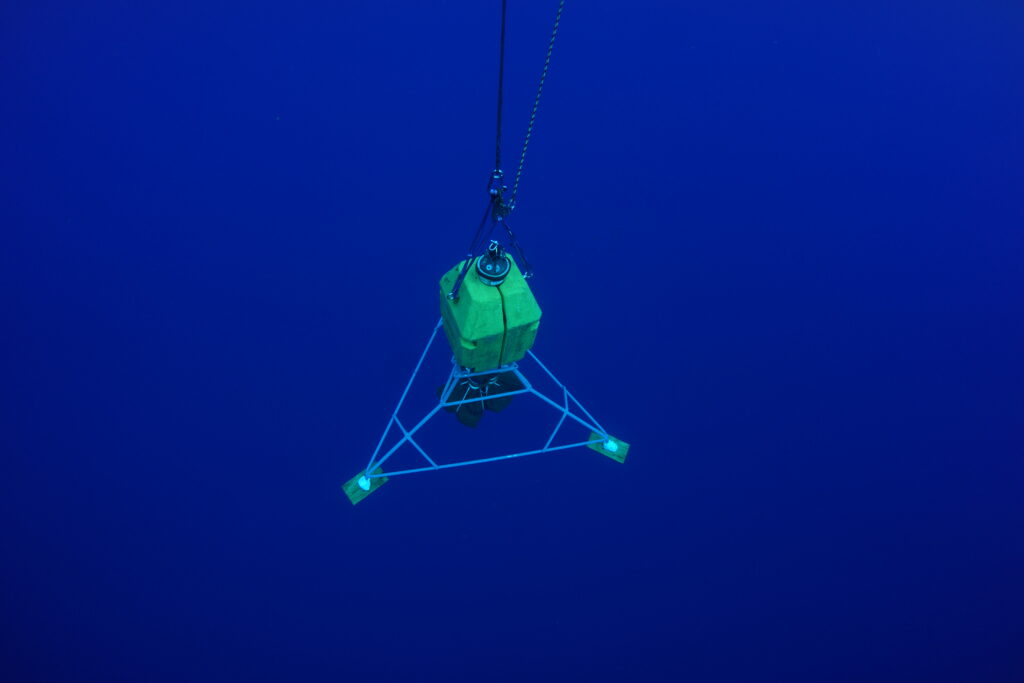

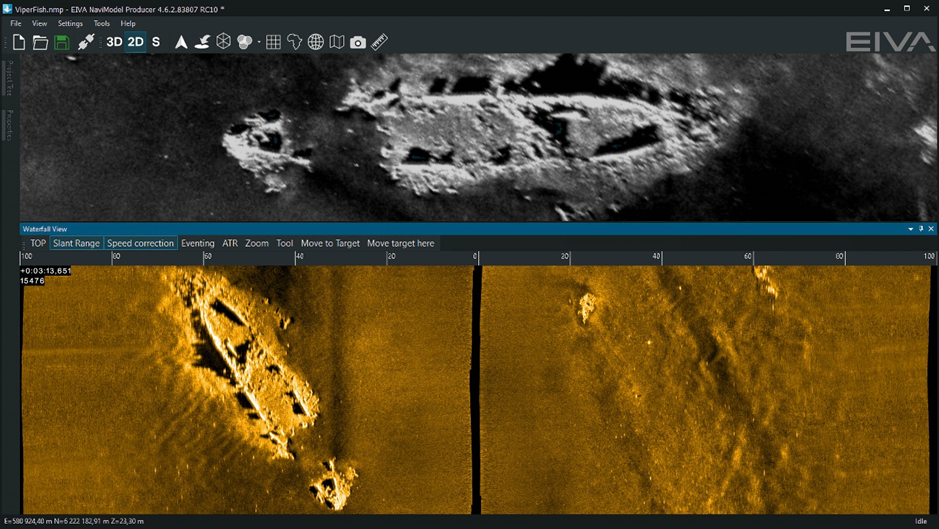

The ViperFish is an all-in-one compact remotely operated towed vehicle (ROTV) ideally suited for expeditionary mine countermeasures (MCM) and explosive ordnance disposal (EOD) surveys. Martin Kristensen, VP of Hardware Development at our technology partner EIVA, explains all in this edition of The Watch.

“The ViperFish is a new surveying platform that we developed to address the growing demand for unexploded ordnance (UXO) surveying in the offshore wind industry,” said Kristensen. “It is a versatile and easy-to-use system that can be deployed from a vessel of opportunity. Expeditionary MCM survey requirements are very similar so navies can benefit from all our commercial experience to make their surveys far more efficient.”

Experience where it counts

“We wanted to incorporate all the lessons we learned from building and operating the ScanFish ROTV, the industry’s leading UXO survey platform, into the design of the ViperFish, creating a UXO surveying platform optimised to meet the demands of our customers. These include increasingly efficient surveys and where possible these needed to be automated. To support an increasing volume of surveys, new ROTVs needed to be compact, easy to launch and recover from a variety of vessels, including uncrewed surface vessels (USVs), and equipped with class-leading payloads and navigation sensors.

The system is built using the same building blocks as the ScanFish, enabling us to leverage all that experience. The first obvious difference between the ViperFish and the ScanFish is the shape. The ViperFish is cylindrical with actuated fins, while the ScanFish is shaped like an airfoil. The new system is as manoeuvrable, but the difference in shape offers a number of benefits:

- A lower drag coefficient: this means that it requires less power to tow. This is important for autonomous UXO surveys, as it allows the ViperFish to be deployed from smaller vessels or even from shore.

- More stability in rough seas: the pitch and roll are controlled by the actuators maintaining a more stable platform enabling you to work closer to the seafloor and maintain a stable platform at the sweet spot for the sensors providing improved data and therefore better decision making.

- A narrower profile enabling operations from smaller vessels: making it easier to transport and deploy. This is a major advantage for expeditionary surveys, as it allows the ViperFish to be deployed and recovered more quickly and easily.

It’s not just the platform. It’s the whole system. We conducted significant research to minimise the cable drag. By doing this, we can operate with smaller winches and deploy from a smaller surface area. We offer two shipment options: a self-contained cradle-box that can be shipped everywhere, or a container ready to integrate into a vessel.

It’s taken some time, but one of the most memorable things about the ViperFish is the first time we put it in the water,” said Kristensen. “On our first prototype test, we were out sailing 3 days and we had 100% uptime on the system. It was really a relief and a joy to see that all of our hard work had paid off.”

All the payloads

The ViperFish is equipped with all the sensors typically required on an ROTV, including:

- Solstice multi-aperture sonar: Used to create a two-dimensional image of the seabed. This image can be used to detect mine-like objects. The ViperFish uses the Solstice from our technology partner Wavefront Systems. This sonar is known for its high resolution and low power consumption.

- R2Sonic 2020 multibeam echosounder: It creates a three-dimensional image of the seabed. This is used to fill the gap ensuring 100 % coverage from a single survey line.

- OFG Hypermag: This magnetometer detects magnetic anomalies in the water or on the seabed generated by mines or other metallic objects while filtering out magnetic anomalies generated by the ViperFish itself.

- SPRINT-Nav Mini hybrid DVL-INS: Used to track orientation, position and speed; this system is from our technology partner Sonardyne. This information is used to create accurate maps of the survey area.

- Mini-Ranger 2 USBL positioning: The ultra-short baseline positioning system is used to track the ViperFish’s position in absolute coordinates. The Mini-Ranger 2 is a class-leading positioning system from our technology partner Sonardyne.

- Valeport sound velocity sensor: the sensor is used to optimise the sonar survey in real time, which is especially important when operating close inshore and within estuaries where sonar conditions can change rapidly.

The integration of these sensors into the ViperFish ROTV makes it a versatile and efficient UXO surveying platform. The ViperFish can be used to conduct surveys in a variety of conditions, and it can detect a wide range of objects.

Low-logistics, simple to operate, quick to train

“The ViperFish is operated by a crew of two people. The survey plans are prepared beforehand using NaviSuite Kuda software from EIVA. When launching the system, one person is responsible for supervising the ViperFish, while the other person controls the crane. At a speed through water of 2 to 10 knots, once in the water the ViperFish automatic controls take over, quickly swimming to the appropriate height from the seafloor within less than a minute. When the system is deployed one person is responsible for monitoring the automated mission while operating the ViperFish’s sensors and collecting data. If the ViperFish detects a possible UXO, the crew can mark the location on a map. The crew can then return to the location at a later time to investigate further. The system follows the seabed at a fixed height and can cope with slopes of up to 45 degrees. Plus it can replan its mission if obstacles are detected and avoid them in a safe manner while still obtaining high-quality data. When the mission is completed, the ViperFish is recovered by the two-person crew. We are also in discussions with USV manufacturers to make the launch and recovery totally automated.”

“The system is relatively easy to operate, even for people who are not trained hydrographers. The whole training process can be completed in a couple of weeks, it is mostly focused on learning how to set up the system and how to operate the sensors. If the crew is already experienced with using autonomous underwater vehicle (AUV) systems or the ScanFish, the training process will be a couple of days at most. Since the user interface of NaviSuite Kuda, EIVA’s survey software, is used widely in the commercial sector, there is already a large pool of contractors and trainers ready to support operations. In addition, sailors will be gaining valuable skills to support their transition to the commercial sector.”

Actionable data

“Ultimately, it’s about delivering our customers the best data, and you’ll be surprised how challenging it is to get these many payloads into the right form factor. But it has been worth it. We offer an incredible amount of area coverage rate of actual actionable data using class leading sensors.”

Please contact us to find out more.